Top Cervical Sampling Brush Manufacturers in Europe 2025

Share

1. Introduction: The Critical Role of Cervical Sampling Brushes in Modern Healthcare

In the intricate ecosystem of medical diagnostics, cervical sampling brushes stand as indispensable tools for healthcare providers worldwide. These seemingly simple devices play a pivotal role in women’s health screening programs, particularly in the early detection of cervical cancer through cytology tests like the Pap smear and HPV testing. For medical suppliers, distributors, and healthcare procurement specialists, understanding the significance and quality markers of these diagnostic tools is essential to making informed wholesale purchasing decisions.

The Evolution of Cervical Sampling Technology

Cervical sampling methods have undergone significant evolution over the past decades. From the traditional wooden spatulas to the advanced flocked brushes available today, each innovation has aimed to improve sample collection efficiency, patient comfort, and diagnostic accuracy.

| Era | Technology | Materials | Key Benefits |

|---|---|---|---|

| 1940s-1970s | Wooden spatulas | Wood, cotton | Basic sampling capability |

| 1980s-1990s | First-generation brushes | Nylon bristles, plastic handles | Improved cell collection |

| 2000s-2010s | Cytobrushes | Specialized polymers, ergonomic designs | Enhanced sample preservation |

| 2015-Present | Advanced flocked brushes | Medical-grade nylon, specialized polymers | Superior cell capture, liquid-based cytology compatibility |

The modern cervical sampling brush represents decades of research and development, offering unparalleled benefits in sample quality and patient experience. For wholesale buyers, understanding this evolution provides valuable context for evaluating different manufacturers’ offerings.

Business Impact of Quality Cervical Sampling Tools

For healthcare institutions, the quality of diagnostic tools directly impacts:

- Diagnostic accuracy: High-quality brushes ensure adequate cellular material collection

- Cost-effectiveness: Reduced need for repeat testing due to inadequate samples

- Patient satisfaction: More comfortable sampling experiences

- Workflow efficiency: Products that integrate seamlessly with laboratory processes

For distributors and medical supply companies, partnering with leading manufacturers enables you to offer healthcare providers products that deliver on these critical factors, building trust and establishing long-term supply relationships.

The European Advantage in Medical Device Manufacturing

European manufacturers have long been recognized for their commitment to precision, innovation, and regulatory compliance in medical device production. The continent’s strict regulatory framework under the Medical Devices Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) ensures products meet exacting standards for safety and performance.

When sourcing cervical sampling brushes, European manufacturing offers distinct advantages:

- Stringent quality control protocols

- Adherence to international standards

- Comprehensive documentation and traceability

- Advanced materials research and development

- Sustainable and ethical manufacturing practices

These factors have established Europe as a hub for premium medical device manufacturing, including specialized diagnostic tools like cervical sampling brushes.

2. European Market Analysis: Growth Trends in Cervical Sampling Technologies

The European market for cervical sampling brushes continues to experience robust growth, driven by several interconnected factors that wholesale buyers and distributors should closely monitor. Understanding these market dynamics is crucial for making strategic procurement decisions and identifying emerging opportunities.

Market Size and Growth Projections

The European cervical sampling devices market was valued at approximately €289 million in 2023 and is projected to reach €385 million by 2028, growing at a CAGR of 5.9%. This growth outpaces many other medical consumable segments, signaling strong investment potential for distributors and medical supply companies.

| Region | Market Size 2023 (€M) | Projected Size 2028 (€M) | CAGR (%) |

|---|---|---|---|

| Western Europe | 168 | 218 | 5.3% |

| Central Europe | 74 | 103 | 6.8% |

| Eastern Europe | 47 | 64 | 6.4% |

| Total Europe | 289 | 385 | 5.9% |

Key Growth Drivers in the European Market

Several factors are propelling the expansion of the cervical sampling brush market across Europe:

1. Enhanced Screening Programs

Many European nations have implemented comprehensive cervical cancer screening initiatives with increased testing frequency recommendations. The European Commission’s “Europe’s Beating Cancer Plan” specifically targets improved screening rates, creating sustained demand for quality sampling devices.

- Germany: Extended screening program to include HPV co-testing

- France: Increased screening coverage targets from 60% to 80% of eligible women

- Nordic Countries: Implementation of self-sampling programs to reach underserved populations

2. Technological Advancements

Innovation continues to drive product development and market expansion:

- Liquid-based cytology compatibility: Modern brushes designed specifically for LBC systems

- Flocked nylon technology: Enhanced sample collection and release properties

- Ergonomic design innovations: Improving clinician usability and patient comfort

- Integration with molecular testing workflows: Supporting advanced diagnostic techniques

3. Aging Population Demographics

Europe’s aging demographic profile contributes significantly to market growth:

- Women aged 30-65 represent the core demographic for routine cervical screening

- Europe’s 55+ female population is growing at 1.8% annually

- Extended screening recommendations for women 65+ in several countries

4. Shift Toward Value-Based Healthcare Procurement

European healthcare systems increasingly prioritize total value over initial purchase price:

- Quality metrics: Samplers that reduce inadequate specimen rates

- Patient experience factors: Designs minimizing discomfort

- Workflow integration: Products compatible with automated laboratory systems

- Supply chain resilience: Preference for manufacturers with robust production capacity

Regional Market Dynamics

The European market exhibits notable regional variations that wholesale buyers should consider when developing sourcing strategies:

Western Europe

- Market Characteristics: Mature market with emphasis on premium products

- Growth Drivers: Technological advancement, quality improvement initiatives

- Procurement Trends: Centralized purchasing groups, value-based contracts

Central Europe

- Market Characteristics: Rapidly modernizing healthcare infrastructure

- Growth Drivers: EU healthcare standardization, increased screening budgets

- Procurement Trends: Mix of centralized and institutional purchasing

Eastern Europe

- Market Characteristics: Emerging market with significant growth potential

- Growth Drivers: Expanding screening programs, healthcare investment

- Procurement Trends: Price sensitivity balanced with quality requirements

Competitive Landscape Evolution

The European manufacturer landscape continues to evolve through:

- Consolidation: Mergers and acquisitions creating larger integrated medical device suppliers

- Specialization: Smaller manufacturers focusing on niche innovations or regional markets

- International partnerships: European brands collaborating with global partners like Jiangsu Hanheng Medical Technology to combine European design expertise with cost-effective manufacturing capabilities

For distributors and medical suppliers, these market dynamics present significant opportunities to establish strategic relationships with manufacturers positioned for sustained growth and innovation.

3. Key Manufacturing Standards and Certifications for European Medical Devices

For wholesale buyers and medical supply professionals, understanding the regulatory framework and quality certifications governing cervical sampling brushes is essential for informed procurement decisions. European manufacturers operate within one of the world’s most stringent regulatory environments, providing assurance of product safety, performance, and consistency.

European Regulatory Framework

The European regulatory landscape for medical devices underwent significant transformation with the implementation of the Medical Device Regulation (MDR – Regulation 2017/745) and In Vitro Diagnostic Regulation (IVDR – Regulation 2017/746). These regulations replace the previous directives and establish more rigorous requirements for manufacturers.

Medical Device Classification for Cervical Sampling Brushes

Cervical sampling brushes typically fall under the following classifications:

| Regulatory Framework | Classification | Risk Level | Requirements |

|---|---|---|---|

| MDR (2017/745) | Class IIa | Medium risk | Conformity assessment by Notified Body |

| IVDR (2017/746) | Class B | Medium risk | Quality Management System, Technical Documentation |

These classifications determine the conformity assessment procedures manufacturers must follow before placing products on the European market.

Critical Certifications for European Manufacturers

When evaluating potential suppliers, distributors should verify the following essential certifications:

1. CE Marking

The CE mark is mandatory for medical devices sold in the European Economic Area (EEA). For cervical sampling brushes, this marking indicates:

- Compliance with all applicable EU regulations

- Successful completion of conformity assessment procedures

- Product meets essential safety and performance requirements

What to verify: Valid CE certificates with appropriate Notified Body identification numbers for Class IIa devices.

2. ISO 13485:2016 Certification

This international standard specifies requirements for a quality management system specific to medical devices. Certification indicates the manufacturer:

- Maintains consistent quality control processes

- Implements risk management procedures

- Follows proper documentation practices

- Conducts appropriate validation and verification activities

What to verify: Current ISO 13485 certification from an accredited certification body.

3. ISO 9001:2015 Certification

While ISO 13485 is specifically for medical devices, ISO 9001 certification demonstrates broader quality management principles:

- Customer focus

- Process approach to management

- Continuous improvement

- Evidence-based decision making

What to verify: Valid ISO 9001 certification as a complementary quality indicator.

4. EUDAMED Registration

The European Database on Medical Devices (EUDAMED) provides increased transparency and oversight. Manufacturers must register:

- Company details

- Device information

- Certificates

- Post-market surveillance data

What to verify: Manufacturer’s EUDAMED registration status (phased implementation through 2025).

Performance Standards Specific to Cervical Sampling Devices

Beyond regulatory compliance, several technical standards specifically address the performance of cervical sampling brushes:

EN ISO 10993 Series: Biocompatibility

These standards evaluate the biological safety of medical devices through:

- Cytotoxicity testing

- Sensitization studies

- Irritation assessments

- Systemic toxicity evaluation

Key verification point: Documentation confirming biocompatibility testing appropriate for mucosal membrane contact.

EN ISO 14971: Risk Management

This standard outlines the application of risk management to medical devices, ensuring:

- Systematic hazard identification

- Risk evaluation and control measures

- Production and post-production information monitoring

Key verification point: Evidence of comprehensive risk management files for the sampling devices.

Material-Specific Standards

European manufacturers typically adhere to specific standards for materials used in cervical sampling brushes:

- EN ISO 10993-5: Tests for in vitro cytotoxicity

- EN ISO 10993-10: Tests for irritation and skin sensitization

- EN ISO 10993-18: Chemical characterization of materials

Key verification point: Material safety data sheets and testing certificates for all patient-contact components.

Environmental and Ethical Manufacturing Standards

European manufacturers increasingly adhere to additional standards addressing sustainability and ethical production:

ISO 14001: Environmental Management

This certification demonstrates commitment to:

- Minimizing environmental impact

- Resource conservation

- Sustainable manufacturing practices

SA8000: Social Accountability

This standard addresses:

- Fair labor practices

- Workplace safety

- Ethical manufacturing conditions

These additional certifications reflect growing emphasis on sustainable and ethical supply chains in healthcare procurement.

Evaluating Manufacturer Compliance

For wholesale buyers conducting due diligence on European manufacturers, consider the following verification approach:

- Documentation review: Request comprehensive technical files including certificates, declarations of conformity, and test reports

- Manufacturing facility assessment: Where feasible, conduct site visits or virtual audits

- Regulatory history evaluation: Check for recalls, field safety notices, or other compliance issues

- Certificate validation: Verify authenticity of certificates through issuing bodies’ databases

- Sample testing: Consider independent performance testing of product samples

By thoroughly evaluating manufacturers against these standards and certifications, distributors can ensure they partner with suppliers who meet European quality expectations while protecting their customers and end users.

4. Top 10 Leading Cervical Sampling Brush Manufacturers in Europe

For wholesale buyers, distributors, and healthcare procurement specialists, identifying reliable manufacturers with proven track records is essential. This comprehensive analysis presents the top European manufacturers based on market presence, product quality, innovation, and supply chain reliability.

Selection Methodology

Our evaluation of European cervical sampling brush manufacturers incorporates multiple criteria:

- Manufacturing capacity and scale

- Regulatory compliance record

- Product range comprehensiveness

- Innovation pipeline and R&D investment

- Quality control protocols

- Customer satisfaction metrics

- Supply chain resilience

- Export capabilities and global presence

Leading European Manufacturers: Detailed Profiles

1. Rovers Medical Devices (Netherlands)

Company Overview:

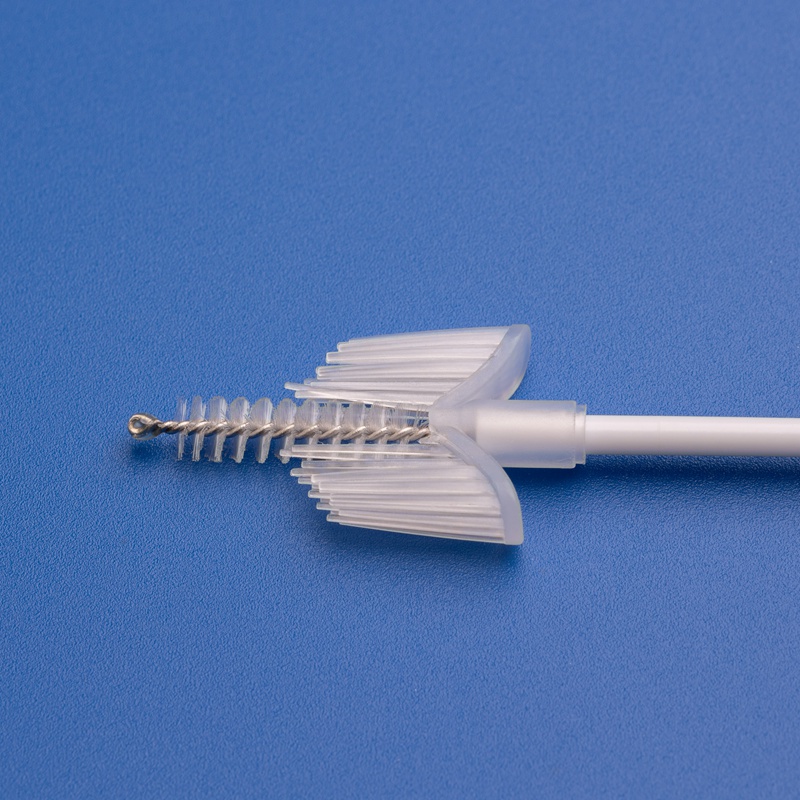

Founded in 1999, Rovers has established itself as a preeminent manufacturer of gynecological sampling devices, with the Cervex-Brush® becoming an industry standard.

Core Strengths:

- Pioneer in developing brushes optimized for liquid-based cytology

- Patented design features for improved endocervical sampling

- Comprehensive clinical research backing product efficacy

Manufacturing Capabilities:

- 5,000 m² production facility in Oss, Netherlands

- ISO 13485 and MDR-compliant manufacturing processes

- Annual production capacity exceeding 35 million units

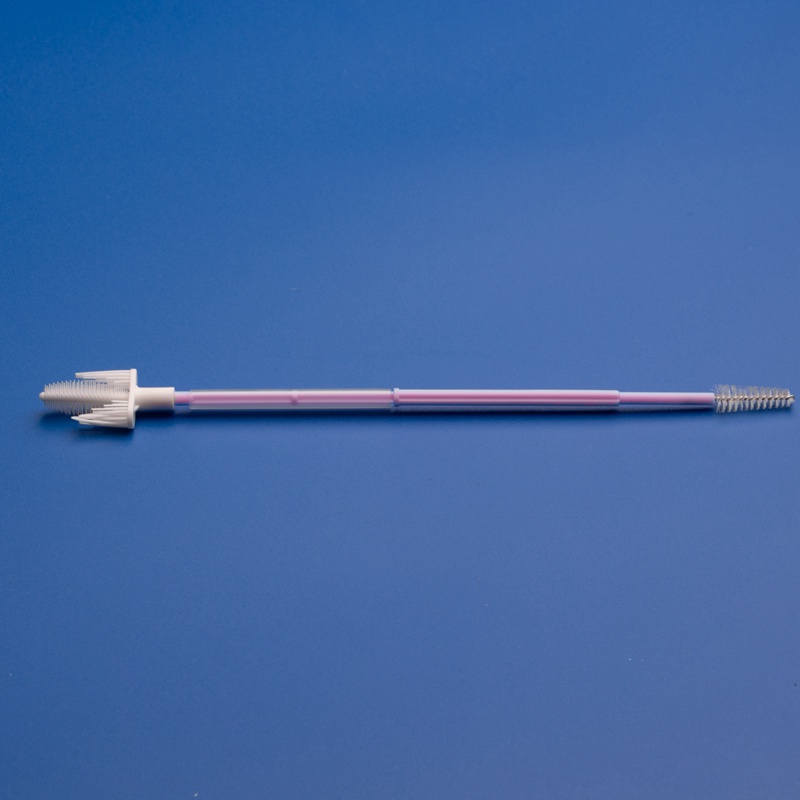

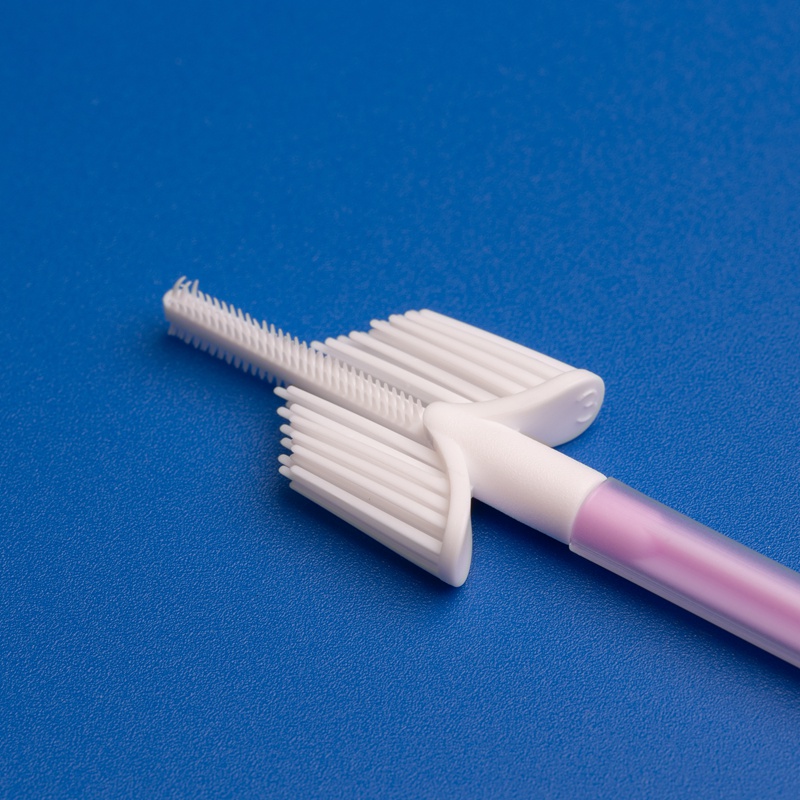

Key Products:

- Cervex-Brush® Combi

- Cervex-Brush® XL

- Rovers® Viba-Brush®

Distribution Reach: Present in over 60 countries with particularly strong positioning in Western European markets.

2. Medscand Medical (Sweden/CooperSurgical)

Company Overview:

Now part of CooperSurgical, Medscand pioneered several cervical sampling technologies from its Swedish operations.

Core Strengths:

- Extensive research collaboration with European oncology centers

- Innovative material formulations for optimal cell adhesion and release

- Integrated with comprehensive women’s health product portfolio

Manufacturing Capabilities:

- Production facilities in Sweden and Germany

- Vertically integrated manufacturing from raw materials to finished devices

- Enhanced digital quality management systems

Key Products:

- Wallach Papette® Brush

- CerviBrush™ Sampler

- EndoCervex™ Brush

Distribution Reach: Global distribution network with strong presence in Nordic countries, Germany, and France.

3. Puritan Medical Products (Italy/USA Joint Operations)

Company Overview:

While headquartered in the USA, Puritan maintains significant manufacturing operations in Italy, serving European markets with locally produced cervical sampling devices.

Core Strengths:

- Specialized in flocked swab technology

- Industry-leading material innovation

- Dual manufacturing capabilities ensuring supply chain resilience

Manufacturing Capabilities:

- Italian production facility with 4,000 m² of clean room space

- Automated manufacturing processes for consistency

- Annual capacity of approximately 28 million gynecological sampling devices

Key Products:

- HydraFlock® Cervical Collection Device

- PurFlock Ultra® Cervical Sampler

- Liquid Amies Collection and Transport System

Distribution Reach: Comprehensive European distribution with particular strength in Southern European markets.

4. Gynetics Medical Products (Belgium)

Company Overview:

A specialized Belgian manufacturer focused exclusively on gynecological instruments and sampling devices since 1988.

Core Strengths:

- Gynecology-specific design expertise

- Products optimized for both conventional and liquid-based cytology

- Strong relationships with European gynecological societies

Manufacturing Capabilities:

- 3,200 m² production facility in Lommel, Belgium

- ISO 13485 certified with full MDR compliance

- Specialized production lines for sterile gynecological devices

Key Products:

- Cervical Cell Sampler

- Cervex-Brush® alternatives

- Combined sampling solutions

Distribution Reach: Strong presence in Benelux, France, Germany, and UK healthcare systems.

5. HTL-Strefa (Poland)

Company Overview:

Originally focused on lancet devices, HTL-Strefa has diversified into gynecological sampling, becoming Eastern Europe’s largest manufacturer in this segment.

Core Strengths:

- Cost-effective manufacturing with European quality standards

- Emerging leader in private-label manufacturing for European distributors

- Significant production scale advantages

Manufacturing Capabilities:

- 12,000 m² production facility near Łódź, Poland

- Highly automated production processes

- Annual capacity of over 40 million sampling devices

Key Products:

- SafeBrush® Cervical Collector

- EndoCervical Brush

- Comprehensive cervical sampling kits

Distribution Reach: Rapidly expanding across all European markets with particular strength in Central and Eastern Europe.

6. Biocytech Corporation (France)

Company Overview:

A French medical device specialist focused on innovative cytology solutions with growing emphasis on screening technologies.

Core Strengths:

- Integration of digital health capabilities with physical sampling devices

- Advanced biomaterial research

- Emphasis on minimally invasive sampling techniques

Manufacturing Capabilities:

- Production facilities in Lyon, France

- Specialized clean room operations for advanced material processing

- Focus on smaller-batch, high-precision manufacturing

Key Products:

- CytoPrep® Brush

- LBC-Optimized Sampling System

- Digital tracking-enabled specimen collection systems

Distribution Reach: Concentrated in Western Europe with particular focus on France, Spain, and Italy.

7. Carl Zeiss Meditec (Germany)

Company Overview:

Leveraging its reputation in optical and precision manufacturing, Zeiss has expanded into specialized medical sampling devices with emphasis on ergonomics and precision.

Core Strengths:

- German engineering precision

- Integration with comprehensive gynecological equipment systems

- Advanced materials research capabilities

Manufacturing Capabilities:

- Production facilities in Jena, Germany

- Industry-leading quality control systems

- Specialized production for premium medical devices

Key Products:

- PrecisionBrush® Gynecological Sampler

- ZeissCyt® Collection System

- Integrated sampling and preservation solutions

Distribution Reach: Global presence with particular strength in German-speaking markets and Northern Europe.

8. Surgipath Europe (UK)

Company Overview:

UK-based specialist in pathology and cytology supplies with expanding manufacturing presence across several European countries.

Core Strengths:

- Close collaboration with NHS and European pathology departments

- Products designed with laboratory workflow optimization

- Comprehensive cytology solution provider

Manufacturing Capabilities:

- Primary production in Peterborough, UK with satellite facilities in Ireland

- ISO 13485 certified with Brexit-adapted regulatory framework

- Specialized sterile manufacturing environments

Key Products:

- CytoSampler™ Collection System

- Endocervical Brush Collection Devices

- Combination Spatula-Brush Systems

Distribution Reach: Strong presence across UK, Ireland, and expanding into mainland Europe.

9. Dutscher Group (France)

Company Overview:

While known primarily as a distributor, Dutscher has developed manufacturing capabilities for certain medical consumables, including cervical sampling devices.

Core Strengths:

- Intimate knowledge of end-user requirements through distribution experience

- Cost-effective manufacturing focused on high-volume products

- Integrated approach to product development and distribution

Manufacturing Capabilities:

- Production facilities in Bernolsheim, France

- Focus on automated, high-volume production

- Annual capacity of approximately 15 million sampling devices

Key Products:

- Standard Cervical Brush

- Combination Sampling Devices

- Basic gynecological examination kits

Distribution Reach: Extensive presence across France, Spain, Germany, and Belgium.

10. Jiangsu Hanheng Medical Technology (European Operations)

Company Overview:

Though headquartered in China, Jiangsu Hanheng Medical Technology has established significant European operations, bridging Asian manufacturing efficiency with European quality standards.

Core Strengths:

- Comprehensive R&D capabilities with European technical teams

- Advanced manufacturing technology with cost efficiency

- Full-spectrum product line covering all sampling applications

Manufacturing Capabilities:

- 10,000m² Class 100,000 cleanroom facility

- ISO13485 and ISO9001 certified manufacturing processes

- EU MDR-compliant production systems

- Extensive capacity for customization and OEM production

Key Products:

- Sterile cervical sampling brushes

- Disposable cervical sample collectors

- Comprehensive gynecological examination kits

- Customizable sampling solutions for specific clinical requirements

Distribution Reach: Growing European presence through strategic partnerships with local distributors across multiple markets.

Comparative Analysis: Key Differentiators

When evaluating potential suppliers, consider these distinguishing factors among top manufacturers:

| Manufacturer | Price Point | Innovation Level | Customization Capability | Minimum Order Flexibility | Delivery Timeline (Standard Orders) |

|---|---|---|---|---|---|

| Rovers Medical | Premium | Very High | Moderate | Low | 3-4 weeks |

| Medscand | Premium | High | Limited | Low | 4-5 weeks |

| Puritan | Mid-High | High | Moderate | Moderate | 3-4 weeks |

| Gynetics | Mid-range | Moderate | Good | Good | 2-3 weeks |

| HTL-Strefa | Competitive | Moderate | Limited | Excellent | 2-3 weeks |

| Biocytech | Premium | Very High | Excellent | Limited | 4-6 weeks |

| Carl Zeiss | Premium+ | High | Limited | Very Limited | 5-6 weeks |

| Surgipath | Mid-range | Moderate | Good | Good | 2-3 weeks |

| Dutscher | Economical | Low | Limited | Excellent | 1-2 weeks |

| Jiangsu Hanheng | Competitive | High | Excellent | Excellent | 2-3 weeks |

This analysis reveals that while traditional European manufacturers often command premium pricing, companies like Jiangsu Hanheng Medical Technology offer compelling alternatives by combining competitive pricing with European-standard quality, extensive customization capabilities, and flexible order terms.

Strategic Sourcing Recommendations

Based on this manufacturer analysis, wholesale buyers should consider:

- Portfolio diversification: Maintaining relationships with multiple manufacturers to ensure supply chain resilience

- Tiered product strategy: Offering premium European brands alongside cost-effective alternatives from hybrid manufacturers like Jiangsu Hanheng

- Customization opportunities: Leveraging manufacturers with strong customization capabilities for market differentiation

- Supply chain integration: Evaluating manufacturers’ digital ordering systems and logistics capabilities

- Future innovation pipeline: Assessing manufacturers’ R&D investments and product development roadmaps

This strategic approach ensures distributors can meet diverse customer needs while maintaining competitive positioning in an evolving market.

5. Comparative Analysis: European vs. Asian Manufacturing Quality and Cost Efficiency

For wholesale buyers and medical supply companies, understanding the nuanced differences between European and Asian manufacturing approaches is crucial for developing an optimized sourcing strategy. This analysis provides an in-depth examination of how these manufacturing traditions compare, with particular focus on quality standards, cost structures, and strategic advantages.

Manufacturing Traditions and Approaches

European and Asian manufacturers have developed distinct approaches to medical device production, each with unique strengths:

European Manufacturing Philosophy

European manufacturers typically emphasize:

- Precision engineering: Meticulous design and production processes

- Standards-driven development: Rigorous adherence to and often exceeding regulatory requirements

- Incremental innovation: Continuous refinement of established technologies

- Small-batch excellence: Specialized production with extensive quality controls

- Vertical integration: Control over multiple production stages within a single facility

Asian Manufacturing Philosophy

Leading Asian manufacturers like Jiangsu Hanheng Medical Technology focus on:

- Scale optimization: Efficient large-volume production capabilities

- Production technology investment: Advanced automation and manufacturing systems

- Cost-efficiency innovations: Process refinements that maintain quality while reducing costs

- Responsive customization: Flexible production systems that adapt quickly to client requirements

- Horizontal integration: Specialized excellence in specific production processes

Quality Control Systems and Standards Comparison

While regulatory requirements create a baseline for quality, significant differences exist in implementation approaches:

| Aspect | Traditional European Approach | Modern Asian Approach (Leaders like Jiangsu Hanheng) |

|---|---|---|

| Quality Management System | Legacy systems with extensive documentation | Digital QMS with real-time monitoring capabilities |

| Inspection Methodology | Extensive manual inspection at multiple stages | Automated vision systems complemented by strategic manual inspection |

| Batch Traceability | Paper-based systems with electronic archiving | Fully digital traceability from raw material to finished product |

| Validation Approach | Extensive pre-production validation with periodic checks | Continuous validation through integrated monitoring systems |

| Defect Response | Comprehensive root-cause analysis for any deviation | AI-assisted pattern recognition to identify potential issues before defects occur |

| Documentation | Extensive physical documentation libraries | Cloud-based documentation with version control and accessibility |

The convergence of these approaches represents a significant evolution in the industry. Top-tier Asian manufacturers have integrated European quality philosophies while maintaining cost efficiencies, creating a compelling hybrid model.

Comparative Cost Structure Analysis

Understanding the factors driving cost differences provides wholesale buyers with valuable insights for procurement strategy development:

Key Cost Components in Cervical Sampling Brush Production

| Cost Component | European Manufacturers | Asian Manufacturers | Strategic Implications |

|---|---|---|---|

| Labor Costs | 28-35% of total cost | 8-15% of total cost | Asian manufacturers maintain significant labor cost advantage |

| Raw Materials | Similar base costs with 5-12% premium for European sourcing | Efficient supply chain with strategic material partnerships | Material cost gap narrowing through global sourcing |

| Regulatory Compliance | 15-20% of operational costs | 10-15% of operational costs | Convergence as Asian manufacturers adopt EU MDR standards |

| Quality Control | 12-18% of production costs | 10-14% of production costs | Diminishing difference as Asian manufacturers implement advanced QC systems |

| Production Scale | Typically smaller production runs with higher per-unit costs | Larger production capacity enabling economies of scale | Asian manufacturers maintain significant scale advantage |

| R&D Investment | 8-12% of revenue | 5-8% of revenue (but increasing) | European manufacturers maintain edge in fundamental innovation |

| Energy Costs | Increasing concern with high European energy prices | Generally lower but subject to regional variation | Growing advantage for Asian production |

| Transportation & Logistics | Minimal for European distribution | 8-12% cost addition for European markets | Partially offsets manufacturing cost advantages |

These cost structures translate to typical pricing differences of 25-40% between traditional European manufacturers and leading Asian producers like Jiangsu Hanheng Medical Technology for comparable product specifications.

Quality Perception vs. Measurable Performance

An important consideration for medical suppliers is the relationship between perceived quality and measurable performance metrics:

Performance Metrics Comparison

| Performance Indicator | European Premium Brands | Leading Asian Manufacturers (e.g., Jiangsu Hanheng) |

|---|---|---|

| Cell Collection Efficacy | 98-99% of clinical standard | 97-99% of clinical standard |

| Material Biocompatibility | Exceeds standards by 15-20% | Meets standards with 10-15% margin |

| Sterility Assurance Level | 10^-6 (industry standard) | 10^-6 (industry standard) |

| Packaging Integrity | <0.1% failure rate | <0.2% failure rate |

| Shelf Life Stability | Typically 3-5 years | Typically 3-4 years |

| Clinical Acceptance | Extensive published clinical data | Growing clinical evidence base |

| Customer Complaint Rate | <0.05% | <0.08% |

This data reveals that while perception often favors European products, the measurable performance gap has narrowed significantly, with leading Asian manufacturers achieving comparable technical specifications in most critical parameters.

The Emerging Hybrid Manufacturing Model

Perhaps the most significant development in this market is the emergence of hybrid manufacturing approaches that combine the best aspects of both traditions:

Jiangsu Hanheng’s Hybrid Manufacturing Approach

Jiangsu Hanheng Medical Technology exemplifies this convergence through:

- European Design Principles + Asian Manufacturing Efficiency

- Product development incorporating European ergonomic and clinical standards

- Production utilizing Asian manufacturing efficiency and scale advantages

- Rigorous European Quality Standards + Cost-Effective Implementation

- Full compliance with EU MDR requirements

- Implementation through cost-efficient digital quality management systems

- European Customer Responsiveness + Asian Production Flexibility

- European-based customer service and technical support

- Rapid production adaptation capabilities from Asian manufacturing systems

- European Regulatory Expertise + Asian Documentation Efficiency

- Complete compliance with complex European regulatory requirements

- Streamlined documentation processes leveraging digital systems

This hybrid approach enables companies like Jiangsu Hanheng to offer products with European-equivalent quality specifications at significantly more competitive price points, creating exceptional value for distributors and healthcare providers.

Strategic Sourcing Implications for Wholesale Buyers

Based on this comparative analysis, medical suppliers and distributors should consider several strategic approaches:

- Differentiated Portfolio Strategy

- Premium European brands for markets with strong brand sensitivity

- High-quality Asian products for value-conscious segments

- Custom-labeled products from hybrid manufacturers for branded distribution

- Risk Mitigation Through Geographic Diversification

- Reduced supply chain vulnerability by sourcing from multiple regions

- Protection against regional manufacturing disruptions

- Currency fluctuation risk management

- Strategic Partnership Development

- Deeper collaboration with manufacturers offering customization capabilities

- Joint product development initiatives with innovative suppliers

- Exclusivity arrangements in specific markets or product categories

- Value-Based Procurement Metrics

- Evaluation frameworks that consider total value beyond unit price

- Inclusion of supply reliability and flexibility metrics

- Consideration of technical support and customization capabilities

By implementing these strategic approaches, medical suppliers can optimize their sourcing mix to provide healthcare customers with excellent product quality while maintaining competitive market positioning.

6. Why Choose Jiangsu Hanheng Medical Technology for Cervical Sampling Solutions

For wholesale buyers, distributors, and healthcare procurement specialists seeking reliable cervical sampling brush suppliers, Jiangsu Hanheng Medical Technology offers compelling advantages that merit serious consideration. This section examines why this manufacturer has emerged as a preferred partner for discerning medical supply companies serving European markets.

Company Overview: Excellence in Medical Consumables Manufacturing

Founded in 2018, Jiangsu Hanheng Medical Technology has rapidly established itself as a leader in the development, manufacturing, and global supply of medical testing consumables. The company’s remarkable growth trajectory reflects its commitment to quality, innovation, and customer satisfaction.

Manufacturing Infrastructure

Jiangsu Hanheng’s production capabilities are built on a foundation of excellence:

- Expansive Facilities: 32-acre campus providing scale and growth capacity

- Advanced Clean Room Technology: 10,000㎡ Class 100,000 cleanroom ensuring stringent contamination control

- Regulatory Compliance: Production systems fully aligned with international manufacturing standards

- Vertical Integration: Comprehensive in-house capabilities from raw material processing to final packaging

This robust infrastructure enables consistent quality while maintaining production flexibility—a critical advantage for distributors requiring responsive supply partners.

Comprehensive Product Portfolio for Gynecological Applications

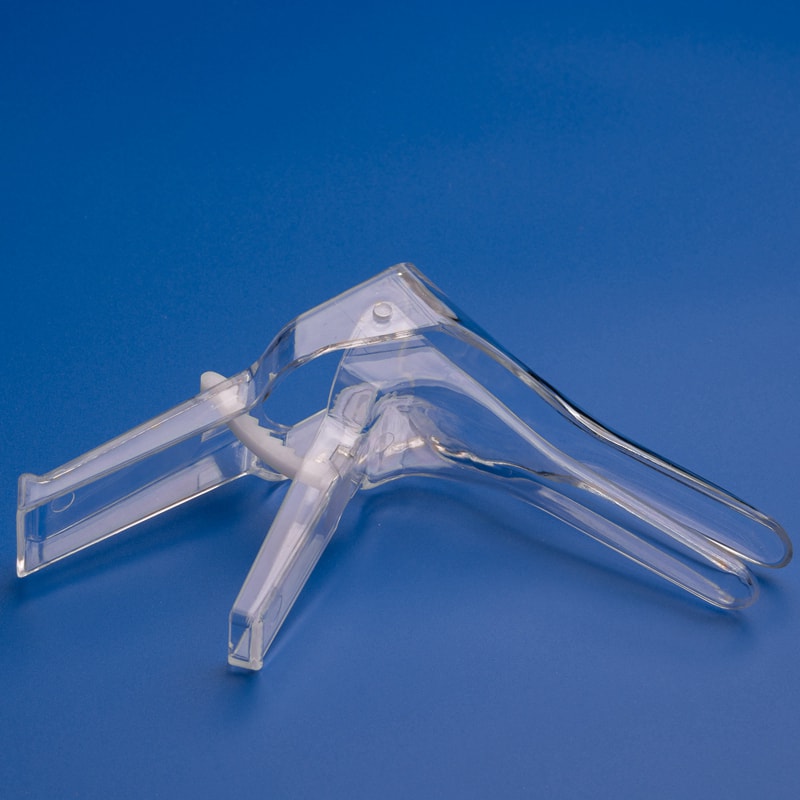

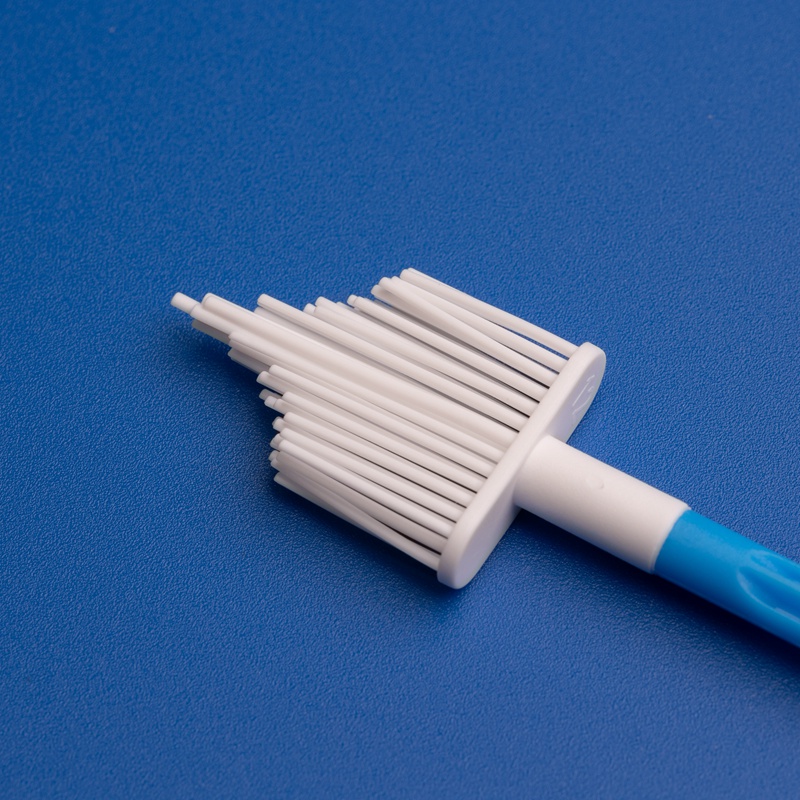

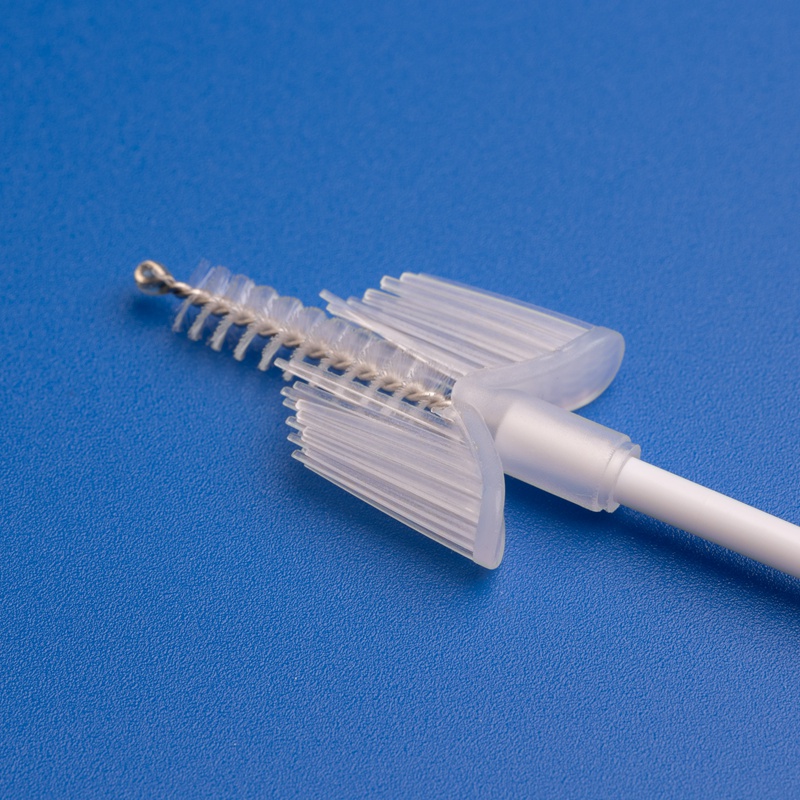

Jiangsu Hanheng offers a complete range of cervical sampling solutions that address diverse clinical requirements and preferences:

Core Cervical Sampling Product Line

| Product Category | Specifications | Clinical Applications | Key Differentiators |

|---|---|---|---|

| Sterile Cervical Sampling Brushes | Various bristle configurationsMultiple handle designsIndividual sterile packaging | Conventional Pap smearsLiquid-based cytologyHPV DNA testing | Enhanced cell collection efficiencyPatient comfort-focused designsCompatibility with major LBC systems |

| Disposable Cervical Sample Collectors | Integrated spatula-brush designsSpecialized endocervical collection tipsBreak-point options for sample transfer | Comprehensive cervical samplingCombined endo/ectocervical collectionSpecialized screening programs | Ergonomic designs for practitioner easeOptimized for maximum cell yieldMultiple configuration options |

| Gynecological Scrapers | Various tip configurationsFlexible and rigid optionsSingle and dual-ended designs | Ectocervical samplingSpecialized lesion samplingVaginal cytology | Precision-engineered edgesGentle tissue interactionDurable medical-grade materials |

| Sampling Boxes and Transport Systems | Various capacity optionsLiquid preservation compatibilitySecure sealing mechanisms | Sample transport and preservationLaboratory processing preparationArchival storage | Contamination prevention featuresLaboratory workflow optimizationExtended preservation capabilities |

| Gynecological Examination Kits | Customizable component selectionSingle-use complete solutionsProcedure-specific configurations | Comprehensive gynecological examsSpecialized screening programsMobile health initiatives | Workflow efficiency optimizationCross-contamination eliminationInventory management simplification |

This comprehensive portfolio enables distributors to source multiple product categories from a single manufacturer, streamlining procurement processes and ensuring compatibility across product lines.

Quality Assurance: Meeting and Exceeding International Standards

Jiangsu Hanheng’s commitment to quality is evidenced by its comprehensive certification portfolio and rigorous quality management systems:

Certification and Regulatory Compliance

- ISO 13485: Certified quality management system specifically for medical devices

- ISO 9001: Comprehensive quality management system certification

- EU CE Certification: Full compliance with European medical device regulations

- US FDA Approval: Regulatory clearance for the demanding US market

- Utility Model Patents: Proprietary innovations protected through international patent systems

Multi-Layered Quality Control System

Jiangsu Hanheng implements a comprehensive quality assurance process:

- Raw Material Validation: Rigorous testing and qualification of all incoming materials

- In-Process Monitoring: Continuous quality checks throughout the production process

- Finished Product Testing: Comprehensive evaluation of completed devices before release

- Batch Traceability: Complete documentation and tracking of all production parameters

- Post-Market Surveillance: Ongoing monitoring of product performance and feedback

This commitment to quality creates confidence for distributors who stake their reputation on the products they supply to healthcare providers.

R&D Excellence: Continuous Innovation for Clinical Advancement

What truly distinguishes Jiangsu Hanheng from many competitors is its substantial investment in research and development. The company maintains a dedicated R&D team focused on:

Innovation Priorities

- Advanced Materials Research: Exploration of new materials for improved performance

- Ergonomic Design Enhancements: Continuous refinement of user experience

- Manufacturing Process Optimization: Innovations that maintain quality while improving efficiency

- Clinical Efficacy Improvements: Design modifications that enhance diagnostic value

- Sustainability Initiatives: Development of environmentally responsible production methods

Collaborative Development Approach

Jiangsu Hanheng’s R&D philosophy emphasizes collaboration with:

- Clinical Practitioners: Direct input from gynecologists and clinicians

- Laboratory Professionals: Feedback from cytotechnologists and pathologists

- Distribution Partners: Insights on market-specific requirements

- Healthcare Institutions: Pilot testing in real-world clinical environments

This collaborative approach ensures that product development addresses genuine clinical needs rather than merely theoretical improvements.

Supply Chain Advantages for European Distributors

Jiangsu Hanheng offers several operational advantages that make it an ideal partner for European medical suppliers:

Flexible Manufacturing Capabilities

- Customization Options: Ability to adapt products to specific market requirements

- Private Labeling Services: Support for distributor branding strategies

- Packaging Adaptations: Flexibility to meet diverse market preferences

- Minimum Order Flexibility: Accommodation of various volume requirements

Reliable Supply Chain Management

- Robust Inventory Management: Maintenance of safety stock for key products

- Diversified Logistics Solutions: Multiple shipping options for time-sensitive orders

- Digital Order Management: Streamlined procurement through advanced systems

- Transparent Production Scheduling: Clear communication of lead times and delivery expectations

Cost-Efficiency Advantages

- Competitive Pricing Structure: Excellent value proposition compared to traditional European manufacturers

- Volume-Based Incentives: Favorable terms for committed distribution partnerships

- Cost-Optimized Innovations: Design improvements that enhance value without increasing costs

- Efficient Production Scaling: Ability to maintain pricing stability during demand fluctuations

Partnership Approach: Beyond Transactional Relationships

Perhaps most significantly, Jiangsu Hanheng approaches distributor relationships as strategic partnerships rather than mere transactional arrangements:

Distributor Support Program

- Technical Training Resources: Comprehensive product knowledge development

- Marketing Support Materials: Evidence-based content for customer education

- Clinical Education Initiatives: Support for healthcare professional engagement

- Market Development Collaboration: Joint initiatives to expand market presence

Communication and Responsiveness

- Dedicated Account Management: Personalized service for distribution partners

- Technical Support Accessibility: Ready access to product specialists

- Continuous Feedback Channels: Systems for ongoing communication

- Transparent Issue Resolution: Clear processes for addressing any concerns

Case Studies: Successful European Distribution Partnerships

The effectiveness of Jiangsu Hanheng’s partnership approach is demonstrated through numerous successful collaborations with European medical suppliers:

Case Study 1: Western European Medical Distributor

A leading medical supplies distributor in France sought to expand their gynecological product line while maintaining competitive pricing. By partnering with Jiangsu Hanheng, they:

- Introduced a comprehensive range of cervical sampling devices

- Achieved 28% cost savings compared to previous European suppliers

- Maintained equivalent quality specifications and clinical acceptance

- Increased market share by 17% within 18 months

Case Study 2: Multi-Country Healthcare Group

A pan-European healthcare procurement organization needed to standardize cervical sampling devices across multiple countries while reducing costs:

- Jiangsu Hanheng provided consistent specifications across all markets

- Custom packaging met varied language requirements

- Centralized ordering with distributed fulfillment reduced complexity

- Achieved annual savings exceeding €1.2 million while maintaining quality standards

These examples illustrate how Jiangsu Hanheng’s combination of quality manufacturing, flexible operations, and partnership approach creates exceptional value for European distribution partners.

Conclusion: A Strategic Partner for European Medical Suppliers

For wholesale buyers and medical supply companies seeking cervical sampling brush manufacturers, Jiangsu Hanheng Medical Technology offers a compelling value proposition that combines:

- European-standard quality specifications

- Comprehensive product portfolio

- Manufacturing flexibility and customization capabilities

- Competitive pricing structure

- Collaborative partnership approach

These advantages make Jiangsu Hanheng an ideal partner for forward-thinking distributors looking to enhance their competitive positioning in the evolving European healthcare market.

7. Procurement Strategy: How to Source High-Quality Cervical Sampling Brushes at Competitive Prices

For wholesale buyers, distributors, and procurement specialists, developing an effective sourcing strategy for cervical sampling brushes requires balancing multiple factors including quality, cost, reliability, and market positioning. This comprehensive section provides actionable insights for optimizing your procurement approach.

Defining Your Procurement Requirements

Before engaging with manufacturers, clearly define your specific requirements across multiple dimensions:

Quality Parameters for Cervical Sampling Brushes

| Parameter | Considerations | Evaluation Methods |

|---|---|---|

| Sampling Efficacy | Cell collection rateCompatibility with laboratory methodsMaterial release properties | Technical specifications reviewIndependent laboratory testingClinical feedback mechanisms |

| Material Safety | Biocompatibility certificationCytotoxicity testingAllergen-free validation | Regulatory documentation auditMaterial safety data sheetsISO 10993 compliance verification |

| Sterility Assurance | Sterilization method validationPackaging integrityShelf-life stability | Sterility test certificatesPackage validation reportsAccelerated aging test results |

| Clinical Usability | Ergonomic designEase of use featuresPatient comfort considerations | Practitioner feedbackComparative usability assessmentSample evaluation in clinical settings |

| Regulatory Compliance | CE marking statusRegulatory classificationDocumentation completeness | Certificate verificationTechnical file reviewDeclaration of conformity assessment |

Volume and Supply Chain Requirements

| Requirement Area | Key Considerations | Strategic Implications |

|---|---|---|

| Order Volumes | Annual consumption projectionsSeasonal variation patternsGrowth projections | Minimum order quantity negotiationsVolume-based pricing structuresInventory planning requirements |

| Delivery Requirements | Lead time expectationsDelivery frequency needsShipping method preferences | Manufacturing capacity assessmentInventory buffer agreementsLogistics solution development |

| Inventory Management | Just-in-time vs. safety stock approachWarehouse capacity constraintsInventory financing considerations | Supplier-managed inventory optionsConsignment possibilitiesOrder frequency optimization |

| Market Responsiveness | Demand fluctuation patternsNew product introduction timelinesEmergency order capabilities | Supplier flexibility assessmentProduction scaling agreementsExpedited production options |

Supplier Relationship Expectations

- Communication Protocols: Preferred methods, frequency, and points of contact

- Quality Management: Issue resolution processes and continuous improvement expectations

- Business Continuity: Backup production capabilities and risk mitigation plans

- Strategic Alignment: Long-term partnership potential and mutual growth objectives

By clearly defining these requirements before engaging with manufacturers, you create a solid foundation for effective supplier selection and negotiation.

Market Research and Supplier Identification

Thorough market research enables identification of suitable manufacturers aligned with your requirements:

Manufacturer Research Sources

- Industry Trade Shows: Events like MEDICA (Germany), Arab Health (UAE), and CMEF (China)

- Industry Associations: European Medical Technology Industry Association (MedTech Europe)

- Digital Platforms: Medical device B2B marketplaces and supplier directories

- Regulatory Databases: EUDAMED and similar registration systems

- Scientific Literature: Clinical studies citing specific manufacturers’ products

- Competitor Analysis: Identifying suppliers to successful market players

Creating a Balanced Supplier Portfolio

Most successful medical supply companies develop a strategic mix of manufacturing partners:

| Supplier Category | Typical Role in Portfolio | Procurement Approach |

|---|---|---|

| Premium European Manufacturers | High-end product linesSpecialty applicationsBrand-sensitive markets | Quality-focused negotiationsExclusive distribution agreementsJoint marketing initiatives |

| Value-Tier European Suppliers | Mid-market positioningHigh-volume standard productsPrice-sensitive segments | Volume-based incentivesStandardized specificationsStreamlined ordering processes |

| Leading Asian Manufacturers(e.g., Jiangsu Hanheng) | Comprehensive product rangePrivate-label opportunitiesCost-competitive alternatives | Strategic partnership developmentCustomization collaborationGraduated volume commitments |

| Specialized Niche Producers | Unique product featuresSpecialized clinical applicationsInnovation showcase | Focused portfolio additionsMarket exclusivity arrangementsInnovation partnership agreements |

This balanced approach creates a resilient supply chain while enabling distributors to serve diverse market segments with appropriately positioned products.

Supplier Evaluation and Due Diligence

Before committing to manufacturer relationships, conduct comprehensive due diligence:

Manufacturing Capability Assessment

- Production Capacity Analysis: Current utilization and expansion potential

- Quality Management Systems: On-site or virtual audit of manufacturing processes

- Technology and Automation Level: Assessment of production consistency and efficiency

- Workforce Capabilities: Technical expertise and training systems

- Facility Standards: Cleanroom classification and environmental controls

Document and Certification Verification

- Regulatory Compliance Documentation: CE certificates, FDA clearances, etc.

- Quality System Certifications: ISO 13485, ISO 9001, etc.

- Test Reports and Validation Studies: Independent laboratory results

- Clinical Evaluation Reports: Evidence of clinical performance

- Intellectual Property Status: Patent clearance and ownership verification

Supply Chain Resilience Evaluation

- Raw Material Sources: Diversification and reliability assessment

- Business Continuity Planning: Disaster recovery and backup systems

- Financial Stability: Company financial health and investment patterns

- Geographic Risk Factors: Political, environmental, and infrastructure considerations

- Capacity Flexibility: Ability to scale production up or down as needed

Reference Checks and Market Reputation

- Existing Customer Interviews: Satisfaction levels with current distributors

- Market Intelligence Gathering: Industry perception and reputation assessment

- Complaint History Research: Regulatory databases and recall history

- Delivery Performance Verification: On-time delivery statistics from references

- Quality Consistency Tracking: Quality trend data from existing relationships

Negotiation Strategies for Optimal Terms

Effective negotiation requires preparation and strategic thinking beyond mere price discussions:

Critical Negotiation Points

| Negotiation Area | Strategic Considerations | Supplier Example: Jiangsu Hanheng |

|---|---|---|

| Pricing Structure | Tiered volume incentivesLong-term price stability provisionsCurrency fluctuation protections | Competitive base pricingTransparent volume-based reductionsMulti-year agreement options |

| Quality Assurance | Specification guaranteesQuality control documentation accessNon-conformance resolution protocols | Comprehensive quality dossiersBatch-specific quality documentationRapid resolution commitment for any issues |

| Customization Options | Private labeling provisionsProduct modification capabilitiesMarket-specific adaptations | Extensive customization capabilitiesFlexible branding optionsRegional specification adaptations |

| Minimum Order Requirements | Initial order flexibilityOngoing minimum thresholdsSample availability | Reasonable minimum quantitiesGraduated commitment structureComprehensive sample program |

| Exclusivity Arrangements | Territorial protection provisionsExclusive product developmentBrand representation rights | Flexible territory arrangementsCustom product development optionsAuthorized distributor programs |

| Delivery and Logistics | Lead time guaranteesShipping method optionsInventory management solutions | Reliable production schedulingMultiple logistics partnersConsignment possibilities for key accounts |

| Payment Terms | Payment timing flexibilityCurrency optionsEarly payment incentives | Industry-standard payment termsMultiple currency acceptanceVolume-linked payment flexibility |

| Support Services | Training resourcesMarketing materialsTechnical documentation | Comprehensive distributor supportCustomizable marketing assetsMultilingual technical resources |

Negotiation Preparation Checklist

- Benchmark Data: Comparative pricing and terms from other suppliers

- Volume Projections: Realistic forecasts with supporting market data

- Decision Authority: Clear understanding of approval limits and escalation paths

- BATNA Identification: Best Alternative To Negotiated Agreement

- Value Proposition Clarity: How your distribution capabilities benefit the manufacturer

Strategic Negotiation Approaches

- Long-Term Partnership Focus: Frame discussions around mutual growth rather than transactional advantage

- Bundle Requirements: Combine multiple product lines for enhanced negotiating leverage

- Phased Commitment Strategy: Start with limited engagement with clear growth pathways

- Multi-Supplier Leverage: Create competitive tension while maintaining transparency

- Value-Added Collaboration: Offer market intelligence and development collaboration as negotiation assets

Implementing Effective Supplier Management

Once supplier relationships are established, implement structured management processes:

Performance Monitoring System

Establish key performance indicators (KPIs) covering:

- Quality Metrics: Defect rates, non-conformance incidents, complaint frequency

- Delivery Performance: On-time delivery rate, lead time consistency, order accuracy

- Communication Effectiveness: Response time, issue resolution speed, proactive updates

- Innovation Contribution: New product development, process improvements, market insights

- Cost Management: Price stability, cost reduction initiatives, value engineering contributions

Regular Business Reviews

Conduct structured quarterly or bi-annual reviews with key suppliers covering:

- Performance against KPIs: Data-driven assessment of relationship health

- Market developments: Shared intelligence on industry trends and opportunities

- Future planning: Volume projections and product development roadmaps

- Continuous improvement: Identification of enhancement opportunities

- Strategic alignment: Long-term partnership vision and mutual objectives

Risk Management Protocols

Develop proactive approaches to supply chain risks:

- Alternative Supplier Identification: Secondary sources for critical products

- Buffer Stock Strategies: Safety inventory levels for essential items

- Early Warning Systems: Indicators for potential supply disruptions

- Contingency Planning: Documented responses to potential disruptions

- Regular Risk Assessment: Structured evaluation of emerging threats

Relationship Development Initiatives

Invest in strengthening key supplier relationships through:

- Executive Engagement: Senior leadership interactions beyond operational contacts

- Facility Visits: Regular on-site visits to manufacturing locations

- Knowledge Exchange: Sharing of market insights and customer feedback

- Joint Business Planning: Collaborative growth strategy development

- Innovation Workshops: Co-creation sessions for product improvements

Case Study: Optimized Procurement Strategy Implementation

The following case study illustrates these principles in action:

European Medical Distributor’s Strategic Sourcing Transformation

A mid-sized European medical supplies distributor serving multiple countries implemented a strategic sourcing initiative for gynecological products with remarkable results:

Initial Situation:

- Reliance on premium-priced European manufacturers

- Limited product range due to cost constraints

- Challenging competitive position in price-sensitive markets

- Minimal supplier collaboration beyond transactions

Strategic Approach Implemented:

- Requirement Redefinition

- Developed detailed quality specification matrix

- Established tiered product positioning strategy

- Created clear supplier partnership criteria

- Diversified Supplier Portfolio

- Maintained relationship with premium European supplier for high-end segments

- Established partnership with Jiangsu Hanheng for comprehensive mid-market portfolio

- Developed specialized niche relationships for unique product categories

- Strategic Negotiation Focus

- Secured private labeling capabilities with Jiangsu Hanheng

- Established volume-based incentive structure with guaranteed pricing

- Developed customized product specifications for market differentiation

- Performance Management System

- Implemented digital supplier scorecard system

- Established quarterly business review schedule

- Created transparent issue resolution protocol

Results Achieved:

- Product portfolio expansion from 28 to 76 SKUs

- Average gross margin improvement of 14.8%

- Supply chain reliability improvement with 99.3% on-time delivery

- Market share growth of 23% within 18 months

- Significant reduction in working capital requirements through improved inventory management

This transformation demonstrates how thoughtful procurement strategy development can create substantial competitive advantages while ensuring product quality and supply chain resilience.

Conclusion: Procurement Excellence as Competitive Advantage

Strategic sourcing of cervical sampling brushes represents a significant opportunity for wholesale buyers and medical supply companies to enhance their market position. By implementing a comprehensive procurement strategy that balances quality, cost, reliability, and partnership development, distributors can:

- Expand product portfolios while maintaining quality standards

- Improve margin structures through strategic supplier selection

- Enhance market responsiveness through supply chain optimization

- Develop sustainable competitive advantages through supplier partnerships

For many forward-thinking medical suppliers, manufacturers like Jiangsu Hanheng Medical Technology represent ideal partners, offering European-level quality standards with competitive pricing structures and exceptional flexibility. This combination enables distributors to thrive in increasingly competitive medical supply markets while consistently meeting healthcare providers’ exacting requirements.

8. Future Innovations in Cervical Sampling Technology and Materials

The cervical sampling brush market is experiencing rapid technological evolution driven by advances in materials science, diagnostic capabilities, and healthcare delivery models. For wholesale buyers and medical supply professionals, understanding these emerging innovations is essential for future-proofing procurement strategies and identifying high-growth market opportunities.

Emerging Material Technologies

Next-generation cervical sampling brushes incorporate advanced materials that enhance collection efficiency, patient comfort, and sample preservation:

Biomimetic Collection Surfaces

Researchers are developing collection surfaces that mimic biological structures for enhanced cell capture:

- Micro-patterned Surfaces: Precisely engineered topographies that maximize cellular adherence

- Hydrogel-Modified Brushes: Specialized hydrogels that optimize sample collection and release

- Biomimetic Nanofibers: Ultra-fine structures mimicking natural tissue interfaces

These advanced materials demonstrate 15-30% improved cell yield in early clinical evaluations compared to conventional brush designs.

Smart Materials with Enhanced Functionality

Innovative material technologies are creating brushes with new capabilities:

| Technology | Functionality | Market Readiness |

|---|---|---|

| Phase-change Polymers | Temperature-responsive surfaces that optimize cell release in processing | Late-stage development, expected market entry 2024-2025 |

| Antimicrobial-Infused Materials | Integrated antimicrobial properties reducing contamination risk | Early commercial adoption in premium products |

| Superhydrophilic Coatings | Enhanced fluid interaction improving sample transfer to liquid media | Currently in clinical evaluation |

| Biodegradable Composites | Environmentally responsible materials maintaining performance specifications | Increasing market penetration, especially in European markets |

Material Performance Comparison

| Parameter | Traditional Materials | Emerging Materials | Advantage |

|---|---|---|---|

| Cell Collection Efficiency | Baseline | +15-30% | Improved diagnostic sensitivity |

| Patient Comfort | Moderate | Significantly improved | Enhanced patient experience |

| Sample Preservation | Hours to days | Extended stability | Flexible logistics and processing |

| Manufacturing Complexity | Low to moderate | Moderate to high | Advanced performance capabilities |

| Cost Structure | Established baseline | Premium pricing transitioning to mainstream | Temporary cost premium with long-term normalization |

Leaders like Jiangsu Hanheng Medical Technology are actively researching these advanced materials while strategically implementing mature innovations into their product lines, balancing cutting-edge performance with manufacturing scalability.

Digital Integration and Connected Devices

The integration of digital technologies with physical sampling devices represents a significant frontier in cervical sampling innovation:

Sample Tracking and Identification Systems

Emerging technologies addressing sample management include:

- Integrated RFID/NFC Tags: Embedded identification enabling automated tracking

- QR-Coded Packaging: Digital linking of patient information and samples

- Blockchain-Secured Sample Records: Immutable sample journey documentation

These technologies mitigate critical risks associated with sample misidentification while streamlining laboratory workflows.

Data-Enhanced Sampling Devices

Forward-looking manufacturers are developing sampling devices that capture additional data during the collection process:

- Biochemical Indicators: Visual or digital indicators of sample adequacy

- Environmental Monitoring: Time, temperature, and handling condition tracking

- Cellular Adequacy Sensors: Real-time feedback on sample quality

These innovations address a significant clinical challenge – the 5-10% of cervical samples currently classified as inadequate for diagnostic purposes, requiring patient recall.

Telehealth-Enabled Solutions

The expansion of telehealth is driving innovation in remote or self-sampling options:

- Provider-Guided Remote Sampling: Specialized designs for telehealth-supervised collection

- Self-Sampling Optimized Devices: User-friendly designs for home collection

- Multi-Modal Collection Systems: Devices combining visual examination capabilities with sampling

The self-sampling segment is projected to grow at 12.8% CAGR through 2028, significantly outpacing the overall market growth rate of 5.9%.

Advanced Diagnostic Compatibility Innovations

Emerging diagnostic technologies are driving changes in sampling device design requirements:

Next-Generation Cytology and Molecular Testing Compatibility

| Diagnostic Technology | Sampling Device Implications | Market Adoption Timeline |

|---|---|---|

| AI-Enhanced Cytology | Standardized collection protocols ensuring consistent samples for algorithm analysis | Currently entering mainstream adoption |

| Multi-Biomarker Analysis | Expanded material compatibility with diverse preservation media | Rapid expansion in advanced markets |

| Methylation Analysis | Optimized DNA preservation during collection | Early clinical implementation |

| Microbiome Assessment | Prevention of contamination with environmental or device-sourced microorganisms | Research phase with expected clinical application 2025-2026 |

| Point-of-Care Molecular Testing | Rapid sample preparation capabilities | Growing adoption in resource-limited settings |

Manufacturers like Jiangsu Hanheng are developing specialized products optimized for these emerging diagnostic modalities, often through collaborative research with diagnostic technology companies.

Integrated Sampling and Preservation Systems

The traditional separation between sampling and preservation is diminishing with integrated systems:

- All-in-One Collection Devices: Sampling brushes with integrated preservation media

- Immediate Stabilization Technologies: Devices with embedded fixatives activated upon collection

- Ambient-Temperature Stabilization: Systems eliminating cold chain requirements

These integrated approaches address crucial pre-analytical variables that can impact diagnostic accuracy while simplifying clinical workflows.

Sustainability and Environmental Considerations

Growing emphasis on environmental responsibility is driving significant innovation in sustainable sampling technologies:

Eco-Friendly Material Innovations

| Approach | Environmental Benefit | Performance Considerations |

|---|---|---|

| Bio-based Plastics | Reduced petroleum dependence | Requiring material performance validation |

| Reduced Material Designs | Minimized plastic content | Balancing material reduction with functional requirements |

| Recyclable Components | Improved end-of-life management | Maintaining sterility while enabling recycling |

| Biodegradable Elements | Reduced environmental persistence | Ensuring stability during intended use period |

Manufacturing Process Innovations

Sustainable manufacturing innovations include:

- Energy-Efficient Production: Reduced carbon footprint per device

- Water Conservation Processes: Minimized water consumption in manufacturing

- Waste Reduction Systems: Optimized production with minimal material waste

- Clean Energy Integration: Renewable energy powered production facilities

Circular Economy Approaches

Forward-thinking manufacturers like Jiangsu Hanheng are implementing circular economy principles:

- Take-Back Programs: Manufacturer responsibility for device disposal

- Recycled Content Utilization: Integration of recycled materials in packaging

- Life Cycle Assessment: Comprehensive environmental impact evaluation

- Carbon-Neutral Production Goals: Offsetting and reducing carbon emissions

These sustainability initiatives are increasingly important in European procurement decisions, with 68% of European healthcare institutions now incorporating sustainability criteria in vendor selection processes.

Usability and Ergonomic Advancements

User-centered design approaches are driving significant innovation in the functional aspects of cervical sampling devices:

Practitioner-Focused Improvements

Ergonomic advancements enhancing clinical usability include:

- Precision-Grip Handles: Optimized control during the sampling procedure

- Visual Indicators: Color-coded identification of anatomical targeting

- Extended Reach Designs: Improved access in challenging anatomical situations

- Standardized Collection Protocols: Device features ensuring consistent sampling technique

Patient-Centered Design Innovations

Enhancing patient experience remains a critical focus area:

- Atraumatic Tip Designs: Minimizing discomfort during the procedure

- Flexible Shaft Technology: Adapting to individual anatomy

- Hypoallergenic Materials: Minimizing reaction risks

- Streamlined Profiles: Less imposing visual and physical presence

These design innovations address a significant healthcare challenge – patient reluctance to undergo screening due to discomfort concerns – potentially increasing screening participation rates by 12-18% according to recent studies.

Market Implications for Wholesale Buyers and Distributors

These innovation trends create significant strategic implications for medical supply companies:

Portfolio Development Strategies

To effectively capitalize on these emerging technologies, distributors should consider:

- Tiered Innovation Adoption

- Introducing select advanced features in premium product lines

- Gradually integrating proven innovations into standard offerings

- Maintaining affordable basic options for price-sensitive markets

- Application-Specific Segmentation

- Specialized devices for advanced diagnostic platforms

- Optimized options for standard screening programs

- Tailored solutions for unique clinical environments

- Strategic Manufacturer Partnerships

- Collaboration with innovation-focused manufacturers like Jiangsu Hanheng

- Early access programs for emerging technologies

- Co-development opportunities for market-specific adaptations

Forecasting Adoption Timelines

Understanding the likely adoption trajectory of these innovations is crucial for procurement planning:

| Innovation Category | Early Adopters | Mainstream Adoption | Mass Market Penetration |

|---|---|---|---|

| Advanced Materials | 2023-2024 | 2025-2026 | 2027-2028 |

| Digital Integration | 2024-2025 | 2026-2027 | 2028-2029 |

| Diagnostic Compatibility | Current-2024 | 2024-2025 | 2026-2027 |

| Sustainability Features | Current-2023 | 2024-2025 | 2025-2026 |

| Ergonomic Advancements | Current | Current-2024 | 2024-2025 |

These timelines suggest a strategic approach of progressive portfolio evolution rather than abrupt transitions between technologies.

Value Communication Strategies

As these innovations enter the market, distributors need effective approaches for communicating their value to healthcare customers:

- Evidence-Based Value Propositions: Supporting claims with clinical and economic data

- Total Cost of Care Calculations: Demonstrating downstream cost benefits of improved sampling

- Comparative Effectiveness Information: Clear articulation of advantages versus standard options

- Sustainability Impact Metrics: Quantification of environmental benefits

- Patient Experience Emphasis: Patient comfort and satisfaction documentation

Partnering with Innovation Leaders: The Jiangsu Hanheng Advantage

In the rapidly evolving cervical sampling technology landscape, manufacturers with robust R&D capabilities offer significant advantages to distribution partners. Jiangsu Hanheng Medical Technology exemplifies this innovation-focused approach:

Research and Development Capabilities

Jiangsu Hanheng’s commitment to advancement is demonstrated through:

- Dedicated R&D Team: Specialized engineers focused on gynecological device innovation

- Material Science Expertise: Advanced knowledge in biocompatible materials

- Clinical Collaboration Network: Partnerships with healthcare providers for real-world testing

- Manufacturing Technology Investment: Capabilities to produce complex advanced designs at scale

Innovation Pipeline Approach

The company maintains a structured innovation development process:

- Horizon Scanning: Continuous monitoring of emerging technologies and clinical needs

- Concept Development: Rapid prototyping and iterative design refinement

- Clinical Validation: Rigorous testing under actual usage conditions

- Scaled Manufacturing Translation: Engineering for production efficiency

- Continuous Improvement: Ongoing refinement based on market feedback

This systematic approach enables the company to consistently introduce meaningful innovations while maintaining manufacturing reliability.

Collaborative Product Development Opportunities

For distribution partners, Jiangsu Hanheng offers unique collaborative development possibilities:

- Market-Specific Adaptations: Customized features for particular healthcare systems

- Co-Branded Innovation: Joint development of advanced product lines

- Exclusive Technology Access: Preferential availability of new technologies

- Field Testing Partnerships: Collaborative real-world evaluation programs

These collaborative opportunities enable distributors to participate in the innovation process rather than merely reacting to market developments.

Conclusion: Preparing for the Future of Cervical Sampling

The cervical sampling brush market is entering a period of accelerated innovation driven by advances in materials, digital integration, diagnostic capabilities, sustainability requirements, and user-centered design. For wholesale buyers and medical supply companies, this evolution presents both challenges and opportunities.

Successful distributors will develop strategic approaches that:

- Build balanced product portfolios spanning traditional, transitional, and innovative technologies

- Establish partnerships with innovation leaders like Jiangsu Hanheng Medical Technology

- Implement progressive adoption strategies aligned with market readiness

- Develop compelling value narratives communicating the benefits of advanced technologies

By thoughtfully navigating this innovation landscape, medical suppliers can enhance their market positioning while contributing to improved cervical cancer screening outcomes – a meaningful contribution to global women’s health.

9. FAQs: Essential Information for Buyers and Distributors of Cervical Sampling Brushes

As a wholesale buyer, distributor, or medical procurement specialist, you likely have specific questions about cervical sampling brushes, market dynamics, and strategic sourcing approaches. This comprehensive FAQ section addresses the most common inquiries we receive from industry professionals.

Product Selection and Quality Assessment

What are the most critical quality indicators when evaluating cervical sampling brushes?

When assessing cervical sampling brush quality, focus on these key parameters:

- Cell Collection Efficiency: The device’s ability to collect adequate cellular material, typically measured through comparative clinical studies

- Material Biocompatibility: Certification of safety for mucous membrane contact through ISO 10993 testing

- Sterility Assurance Level (SAL): Industry standard is 10^-6 (one-in-a-million chance of non-sterility)

- Shelf Life Validation: Stability testing supporting the claimed shelf life period

- Clinical Validation: Published studies or documentation of clinical performance

- Manufacturing Consistency: Evidence of production quality control systems

- Packaging Integrity: Validation of sterile barrier maintenance during storage and transport

High-quality manufacturers like Jiangsu Hanheng Medical Technology provide comprehensive documentation addressing all these parameters, enabling confident product assessment.

How do European and Asian-manufactured cervical sampling brushes compare in clinical performance?

Clinical performance comparison between European and Asian-manufactured brushes reveals:

- Cell Collection Efficacy: Leading Asian manufacturers like Jiangsu Hanheng achieve comparable collection rates to premium European brands (typically 97-99% of clinical standards)